By Marc C. Shaffer

As financial advisors, one of the most common concerns we hear from clients is about the future of Social Security. Many ask how confident we are that their benefits will be available when it’s their turn to file a claim. Some are so worried about potential changes that they’re considering claiming earlier than might be optimal for their situation.

We understand these concerns. The headlines about Social Security’s financial challenges can be alarming. However, it’s crucial to approach this topic with a balanced perspective and to remember that your claiming strategy should be based on your specific circumstances, not on fear or speculation.

This blog post aims to provide you with a clearer picture of Social Security’s current state and future outlook. Our goal is to address your concerns and remind you that we’re here to help you navigate your options, taking into account factors like tax consequences, your health, Roth conversion opportunities, coordination of benefits between you and your spouse (if applicable) and IRMAA (Income-Related Monthly Adjustment Amount) issues.

Key Points About Social Security’s Future:

- Social Security is facing challenges, but it’s not disappearing.

The Old-Age and Survivors Insurance (OASI) Trust Fund is estimated to be depleted by 2033. Even if no changes are made, the system could still pay about 79% of scheduled benefits after 2033. This means that even in a “worst-case” scenario, a significant portion of benefits would continue to be paid.

- Most benefits are funded by current workers’ payroll taxes.

In 2024, $1.23 trillion came from payroll taxes, while $1.385 trillion was paid out in benefits. The gap is currently filled by trust fund reserves, which are dwindling. This ongoing payroll tax revenue ensures that benefits will continue, even if at reduced levels, without legislative action.

- Potential solutions are being discussed:

- Increasing payroll tax by 3.33 percentage points

- Reducing benefits by 20.8% for all beneficiaries

- A combination of smaller adjustments to taxes and benefits

These solutions show that the changes required to sustain the system may not be as drastic as some fear.

- Congress has historically acted to shore up the system.

The last major reform was in 1983, enacted just before benefits would have been reduced. This historical precedent suggests that action is likely before drastic benefit cuts occur.

- Your personal situation matters.

The impact on your retirement plan depends on your individual circumstances. We can model different scenarios to see how potential changes might affect you. This personalized approach is crucial for making informed decisions about when to claim benefits.

Possible Policy Options to Fill Social Security’s 75-year Funding Gap

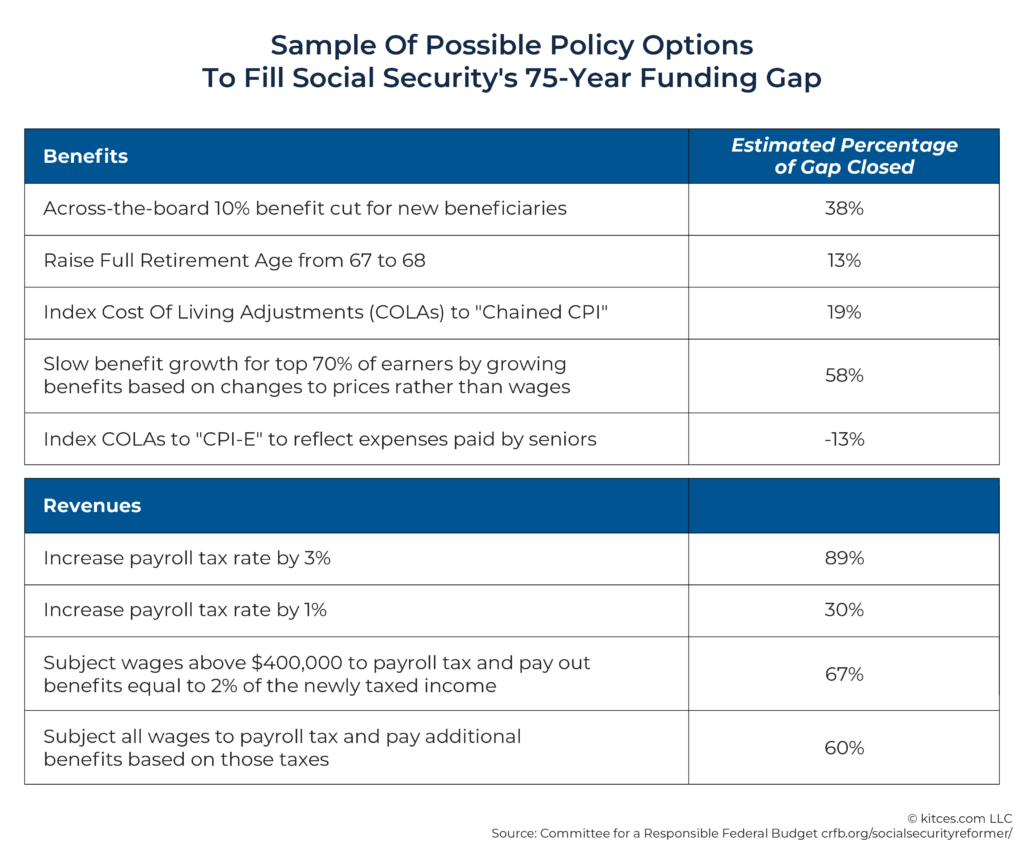

There are numerous policy options being considered to address Social Security’s long-term funding shortfall. Here’s a more detailed look at some of these options and their potential impact:

- Increase Payroll Tax Rate: An immediate increase of 3.33 percentage points (from 12.4% to 15.73%) could eliminate the entire 75-year shortfall.

- Eliminate the Payroll Tax Cap: Currently, earnings above $168,600 (2024) are not subject to Social Security taxes. This wage limit increases to $176,100 in 2025. Eliminating this cap could reduce the shortfall by about 60%.

- Raise the Full Retirement Age: Gradually increasing the Full Retirement Age (FRA) to 69 could reduce the shortfall by about 39%.

- Reduce Cost-of-Living Adjustments (COLAs): Switching to a chained CPI for calculating COLAs could reduce the shortfall by about 19%.

- Reduce Benefits for Higher Earners: Adjusting the benefit formula to reduce benefits for the top 70% of earners could reduce the shortfall by about 58%.

- Increase Coverage: Extending coverage to newly hired state and local government employees could reduce the shortfall by about 6%.

It’s important to note that these are just samples of possible options. The actual solution may involve a combination of these or other measures. The key takeaway is that there are multiple paths to addressing Social Security’s funding challenges, and the changes may not be as drastic as some fear.

What This Means for Your Claiming Strategy:

1. Don’t let fear drive your decision.

Claiming early based on fears about Social Security’s future might not be the best strategy for you. Early claiming can permanently reduce your benefits, which could be costly over a long retirement.

2. Consider your overall financial picture.

Your Social Security claiming strategy should be part of a comprehensive retirement plan. Factors like your other income sources, health, and family longevity play crucial roles in determining the best time to claim.

3. Be aware of related issues.

Your claiming decision can affect:

- Tax consequences on your overall retirement income

- Opportunities for Roth conversions

- Potential IRMAA surcharges on Medicare premiums

4. Stay flexible.

We can create strategies that allow for adjustments as more information about Social Security’s future becomes available.

5. Seek professional advice.

The complexities of Social Security claiming strategies, especially when considered alongside your overall financial plan, often benefit from professional analysis.

Moving Forward

As your advisors, we’re here to help you navigate these uncertainties. We can work together to:

- Review your personal retirement strategy

- Model different Social Security scenarios based on your specific situation

- Develop a claiming strategy that aligns with your overall financial goals

- Adjust your plan as needed when new information about Social Security becomes available

Remember, Social Security is just one part of a comprehensive retirement plan. By taking a holistic view of your finances, we can help create a strategy that’s resilient to potential changes in the Social Security system.

Stay informed, but don’t panic. With proper planning, we can prepare for various outcomes while working towards your retirement goals. Let’s schedule a time to discuss your personal Social Security strategy and ensure it’s optimized for your unique circumstances.

Source:

“Helping Nervous Clients Understand the (True) State of the Social Security System, and What it Means for Their Retirement” by Adam Van Deusen, Nerd’s Eye View October 2, 2024