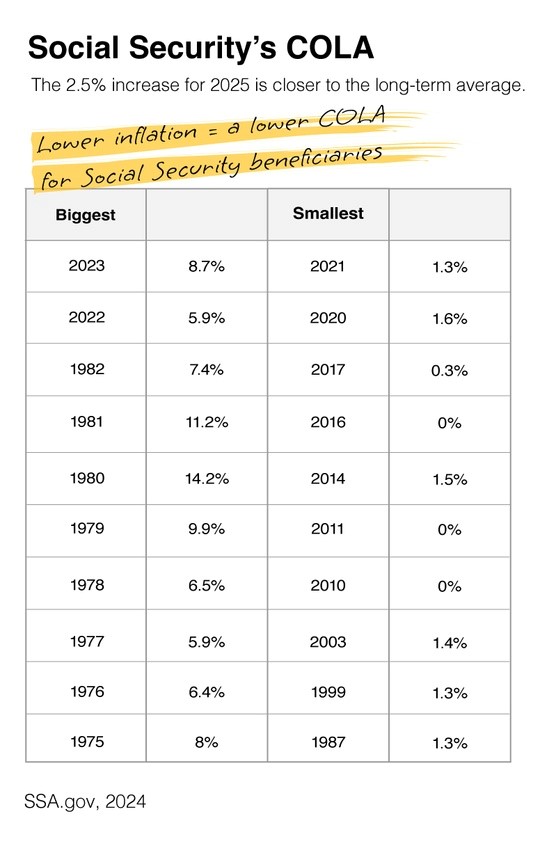

Social Security beneficiaries will see a 2.5% increase in their benefit payments in 2025, according to the Social Security Administration.

The annual cost of living (COLA) adjustment will affect more than 72.5 million Social Security and Supplemental Security Income (SSI) beneficiaries. This year, Social Security beneficiaries will get a new one-page COLA summary that will detail the new benefits and the exact date the 2025 adjustment will start.

Just how much of an increase will depend on the size of the Medicare Part B premium, which is projected to increase to $184 a month in 2025, up from $174.70. Typically, Medicare Part B payments are deducted from Social Security benefits in advance.

Social Security plays an important role in retirement. In fact, the 2024 Employee Benefit Research Institute report found that three out of five retired Americans say Social Security is a major source of income in their retirement. While it’s been known for months that the 2025 increase would be smaller than the 2023 and 2022 increases, the final number may impact your overall financial picture.

If that’s the case, please let us know as soon as possible. Your retirement income needs may change over time, so let’s not miss an opportunity to make any small adjustments needed to make you feel a little more comfortable as the calendar turns to 2025. If nobody is helping you plan for retirement or factor these adjustments in to your plan, we would be happy to help.

Sources:

CNBC.com, October 10, 2024; ThinkAdvisor.com, October 10, 2024