By Michael J. Searcy

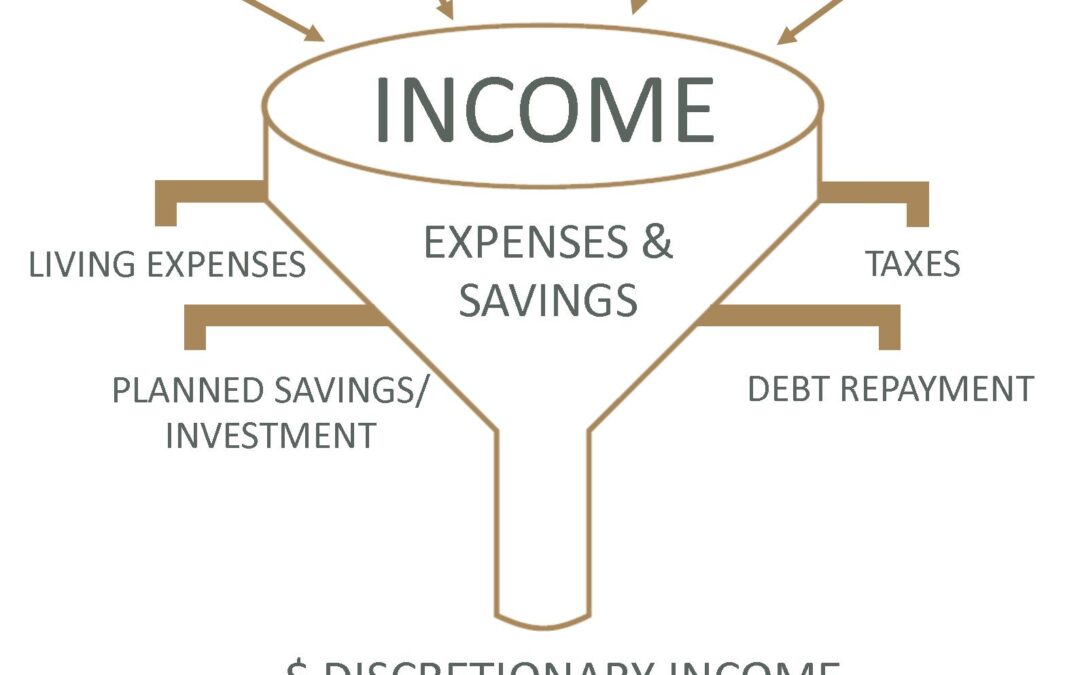

Yes, you have seen some variation of this image before. Yes, some long time clients tease us about drawing it too often. And yes, it is pretty simplistic. However, it gets the point across, is easy to understand, and it impacts everybody, including those with substantial six-figure incomes.