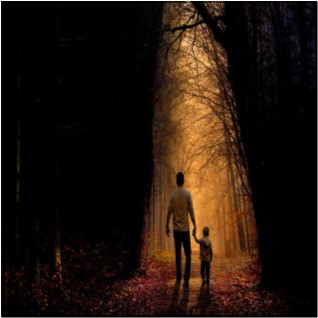

Passing your estate to an heir with credit problems, a shaky marriage, a gambling or alcohol addiction, or any other concerning situation might not only lead to that wealth being squandered, but the inheritance could worsen destructive behaviors.

Of course, you don’t want to disinherit your child(ren) simply because of their personal challenges. There are potential solutions that allow parents to control and incentivize behaviors long after they are gone, helping ensure that a troubled child’s inheritance won’t be misused.

You do not want to avoid or delay creating a plan hoping that your heir’s issue will go away. This could result in you passing before any plans have been set and the inheritance could be given without restrictions.