A Framework That Matches How We Plan for Life

By Marc C. Shaffer

At Searcy Financial Services and Allos Investment Advisors, we believe true wealth goes beyond just your bank account. That’s why The Five Types of Wealth by Sahil Bloom immediately grabbed my attention – and held it. As both a financial planner and someone who’s always seeking personal growth, I found Bloom’s framework refreshingly holistic and deeply relatable.

In the book, Bloom outlines five distinct (but interconnected) types of wealth that contribute to a rich and meaningful life:

- Financial Wealth – Your money, investments, and assets.

- Time Wealth – The freedom to spend your time the way you want.

- Physical Wealth – Your health, energy, and vitality.

- Social Wealth – Your relationships, community, and network.

- Mental Wealth – Your inner peace, mindset, and emotional well-being.

While many people instinctively focus on Financial Wealth, as we’re often taught to from a young age, Bloom makes a compelling case that a truly fulfilling life requires investment in all five areas. And as someone who has spent over two decades helping people plan their financial lives, I couldn’t agree more.

Why This Framework Resonated With Me

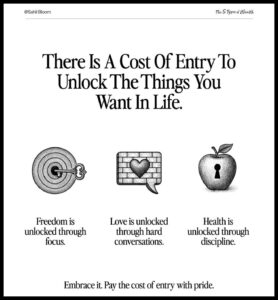

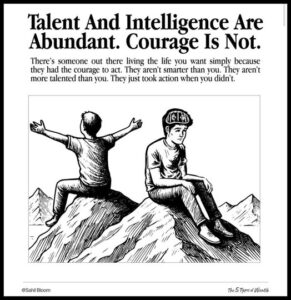

Following Sahil Bloom on LinkedIn has also been a refreshing experience. He regularly shares simple, powerful graphics that are incredibly relatable and remind his followers of what’s truly important in life. It’s another way he reinforces the themes in his book, and it’s part of why his message has stuck with me beyond the pages.

The beauty of Bloom’s concept is in its simplicity. Yet, as simple as it sounds, it hits hard when you realize how easy it is to neglect one of these areas – especially when another is growing rapidly. Some examples can be found below.

Personally, I’ve found myself falling into that trap more than once. As a business owner and driven individual, I’ve had seasons where career and financial goals took center stage, leaving less time for relationships, physical health, or simply being present in the moment. Reading The Five Types of Wealth helped me re-center and reminded me that an imbalanced life, no matter how “successful” on paper, isn’t sustainable or satisfying long term.

In fact, the five types of wealth are very similar to a set of life categories I’ve worked on with my own coach. The overlap was uncanny. It made me realize that this isn’t just a feel-good framework – it’s a strategic tool for evaluating how we’re doing and what we might want to prioritize next. My group coaching circle is also looking forward to reading this book together, which will no doubt spark meaningful discussion and shared insights.

A New Lens for Financial Planning

In our work at Searcy and Allos, we aim to support more than just our clients’ net worth. Our goal is to help people live intentional, well-rounded lives – lives that reflect their values, dreams, and evolving priorities. Bloom’s five-part model mirrors that philosophy beautifully.

Here’s how each type of wealth can show up in the planning conversations we have with clients:

- Financial Wealth: This is where most financial planning starts – saving, investing, and building assets. It’s the fuel that powers many of the other types of wealth.

- Time Wealth: We often talk with clients about how their money can buy freedom – not just more stuff. Retiring early, cutting back hours, or funding a sabbatical are all ways to reclaim time.

- Physical Wealth: Your health is your wealth. We help clients plan for fitness expenses, healthcare needs, and longevity so their bodies and minds can keep up with their goals.

- Social Wealth: Relationships often drive our financial decisions, from how we support family to how we give back. We encourage clients to nurture these connections intentionally.

- Mental Wealth: Peace of mind is a major theme in our work. Whether it’s simplifying complex finances, reducing debt stress, or preparing for uncertainty, we want clients to feel secure and confident.

This book gave me another great tool to bring these conversations to life and I’ve already found myself recommending it to clients, team members, and friends.

The One Wealth Type You Might Be Overlooking

As a financial planner, I’ve noticed that most people assume more financial wealth will solve all their problems. But in reality, you can have a fully funded retirement plan and still feel exhausted, lonely, or anxious.

That’s why I appreciated Bloom’s emphasis on balance. The idea isn’t to max out each type of wealth all the time (that’s probably impossible). It’s to regularly reflect on where you’re thriving and where you’re lacking and then make small, intentional shifts.

Sometimes, your richest season in life won’t be the one with the highest paycheck. It might be the one where you finally reclaim your mornings, reconnect with loved ones, or find inner calm.

Want to Go Deeper? Try These Book Pairings for Each Wealth Type

If The Five Types of Wealth inspired you like it did me, here are some of my favorite books that align with each type of wealth and offer additional insights:

- Time Wealth: Buy Back Your Time by Dan Martell, Miracle Morning for Entrepreneurs by Hal Elrod

- Financial Wealth: The Four Spiritual Laws of Prosperity by Edwene Gaines, The ONE Thing by Gary Keller and Jay Papasan

- Physical Wealth: High Performance Habits by Brendon Burchard

- Social Wealth: The Alchemist by Paulo Coelho, Never Eat Alone by Keith Ferrazzi

- Mental Wealth: The Miracle Morning by Hal Elrod, The Alchemist (again, it’s that good!)

Each one helped shape my thinking, and I hope they do the same for you.

This message also resonates deeply with the themes in my upcoming book, One For All: How to Systemize Kindness, Grow Your Network, and Support Others Like It’s Your Job. In both the book and this blog, the heart of the message is about building a life that is meaningful, connected, and balanced – where your time, relationships, mindset, and resources all work together for the greater good.

Want to stay updated on the book release this summer? Sign up for updates here.

The Five Types of Wealth offers a framework I believe in deeply, and one we already align in parts with, in spirit, at Searcy Financial Services and Allos Investment Advisors. If you’re someone who’s felt off-balance or unsure of what “wealth” really means to you, this book might just be the reset you need.

It also reminded me that wealth isn’t about having it all – it’s about being intentional with what you have and how you use it.

If you’re ready to take stock of your own five types of wealth, let’s talk. And if you’re looking for a book that goes beyond financial strategies and into life strategies, give Sahil Bloom’s book a read. It’s a fast, accessible, and highly actionable guide for anyone looking to live more fully.

Here is a great conversation from Sahil: The Harsh Truth About Money & Happiness That NO ONE Is Talking About Feat. Sahil Bloom

The opinions expressed herein are those of certain Searcy Financial Services, Inc. personnel and are subject to change without notice. The opinions expressed are as of the date of publication and are subject to revision due to changes in the market or economic conditions, which may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by others in the firm, and are meant for general informational purposes as of the date indicated. Searcy Financial Services, Inc. is not compensated by this vendor, nor are there material conflicts of interest that would affect the given statement.