When building a financial strategy, we work hard to create an approach that plans for your longevity and allows you to live a satisfying life. But beyond helping clients prepare for a longer retirement, we are focused on addressing a key goal: Managing emotional reactions.

For many investors, the market’s inevitable fluctuations can make investing feel like an emotional roller coaster. However, letting erratic, short-term market movements create anxiety can lead to detrimental financial decisions.

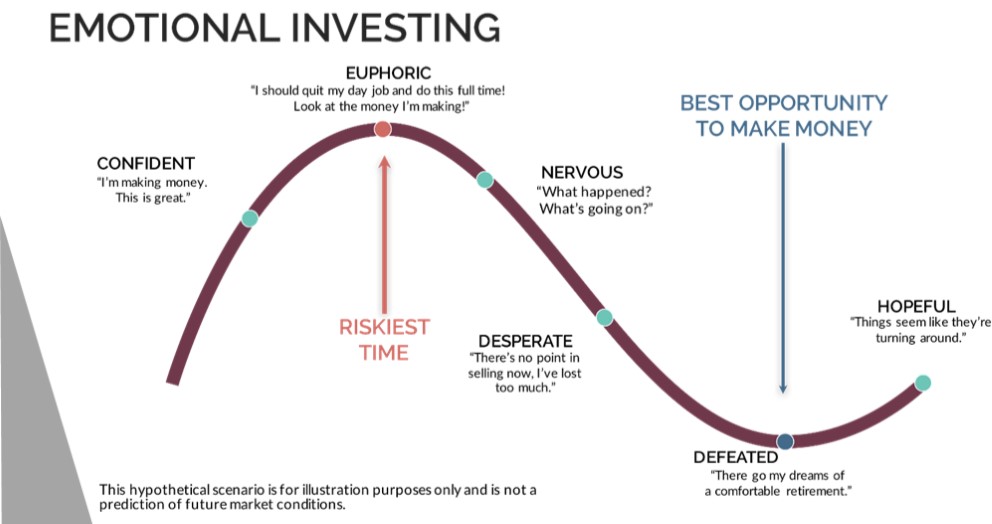

Consider this graphical depiction of the emotional investing rollercoaster:

Many investors allow emotions to affect the way they invest, and instead of staying invested for the long run, they tend to buy high and sell low. Not only do people not want to miss a big increase in the market (thus buying when we’re at an all-time high), but one of the biggest mistakes investors make is to panic during rough markets and hit the eject button.

“…be fearful when others are greedy and be greedy only when others are fearful.” – Warren Buffet

In 2017, people started investing more in the market not based on fact, but because they saw it was rising and didn’t want to miss out. This is how we move from Confident, when markets are stable and rising based on real indicators, into Euphoric, when current investors start feeling too safe with the market and non-investors jump in because things seem great. And whether we experience a large pull back or even just a quick dip in the market, the fear kicks in and sends us down into Desperate and Defeated lows. As your advisor, our goal is to help you gain the long-term perspective you need and avoid making knee-jerk reactions that can derail your financial future.

Unfortunately, making the emotional decision to buy or sell can be very damaging to your long-term performance. We understand how difficult it can be to remove emotion, which is one reason we have an investment committee that meets to determine the best course of action and keep our emotions in line. We also follow a process for investing that help us remove those emotional tendencies and follow the process we have outlined to navigate market movement.

We know it’s not easy when times seem tough, but we’re here acting as your safety belt and you can hold on tight with us as we experience the downs and ups of the market. Having a well-structured portfolio that contains a variety of investments, pursues individual objectives, and reflects personal risk tolerance is incredibly important for reaching your goals.